Thabet một cổng game tuyệt vời dành cho mọi tay chơi cá cược trực tuyến. Từ khi ra mắt đến nay cổng game này đã mang đến cho thị trường cá cược online một làn gió mới cực kỳ đẳng cấp.

Nếu bạn là một tay cược đã có tuổi trong thị trường này thì chắc Thabet sẽ là cái tên gì đó rất quen thuộc phải không nào? Còn nếu bạn là một tay cược mới và chưa thực sự hiểu rõ sân chơi này thì tìm hiểu trong bài viết này nhé!

LỊCH BẢO TRÌ THA- THABET hôm nay 26/04/2024

| Thời gian | Nội dung bảo trì |

|---|---|

| 4:32 | ViettelPay quét mã bảo trì hoàn tất. |

| 7:29 | KU Thể Thao và Cool-In-Live bảo trì hoàn tất, xin lưu ý! |

| 10:23 | Sảnh Bắn cá 3D bảo trì hoàn tất. |

| 16:50 | VIB Ngân hàng bảo trì hoàn tất. |

| 19:15 | WM Casino bảo trì hoàn tất ! |

| 21:45 | Sảnh KA Bắn cá bảo trì hoàn tất. |

Thabet – Giới thiệu cổng game của mọi tay chơi cờ bạc trực tuyến

Đối với những người chơi ít khi cập nhật tin tức, Thabet sự ra đời dưới sự hợp tác một cách chặt chẽ giữa Nhật và Trung được giới trẻ Việt Nam ưa chuộng. Thabet với khẩu hiệu “An toàn Uy tín, Thuận tiện Kịp thời, Công bằng và Công bằng” đã đủ để lấp đầy niềm tin của người tiêu dùng.

Ra đời khi 2003, khi mà Việt Nam còn chưa phát triển về mặt xã hội và đời sống … mọi thứ chưa phát triển như ngày nay, nhưng vào thời điểm đó cổng game đã rất nổi tiếng ở các nước khác như Malaysia, Campuchia, v.v.

Vài năm sau, Tha không còn xa lạ với dân chơi những năm 2010, lúc đó nhà cái đang dần được biết đến và nổi tiếng tại Việt Nam. Để đáp ứng nhu cầu cũng như sự phát triển kinh tế, Thabet ngày càng nâng cao giá trị và phát triển không ngừng các sản phẩm cá cược cho người chơi cho đến ngày nay.

Về tình hình hoạt động, hiện tại tên nhà chính thức vẫn là Tha bet, thuộc sở hữu của Tập đoàn giải trí Tha và có trụ sở lớn đặt tại Manila, Philippines, các văn phòng đại diện được xây dựng và phân bổ khắp Đông Nam Á.

Thị trường chính của nhà cái Tha hiện nay chủ yếu là các nước Thái Bình Dương như Trung Quốc, Philippines, Malaysia, Việt Nam, .. do nhu cầu giải trí rất lớn nên số lượng người chơi tại Thabet rất đông, phải lên đến hàng triệu người.

Thabet- Điểm mạnh ở cổng game uy tín, tải app dễ dàng

Được biết, CEO của Tha bet từng công khai chia sẻ quan niệm của mình: “Chỉ có sáng tạo mới có thể dẫn dắt ngành công nghiệp, chỉ có dịch vụ mới có thể phát triển bền vững”.

Thabet với hơn 20 năm kinh nghiệm trong ngành, các sản phẩm của Tha được các game thủ đánh giá cao và khẳng định được giá trị khẳng định của mình cho đến nay. Casino Tha là duy nhất, độc quyền và sẽ không có nơi nào giống Tha

Tiêu chí để Tha casino hoạt động và phát triển bền vững trên thị trường là Chất lượng, Bảo mật và Tính hợp pháp. Vậy những điểm mạnh có ở địa chỉ game này là gì?

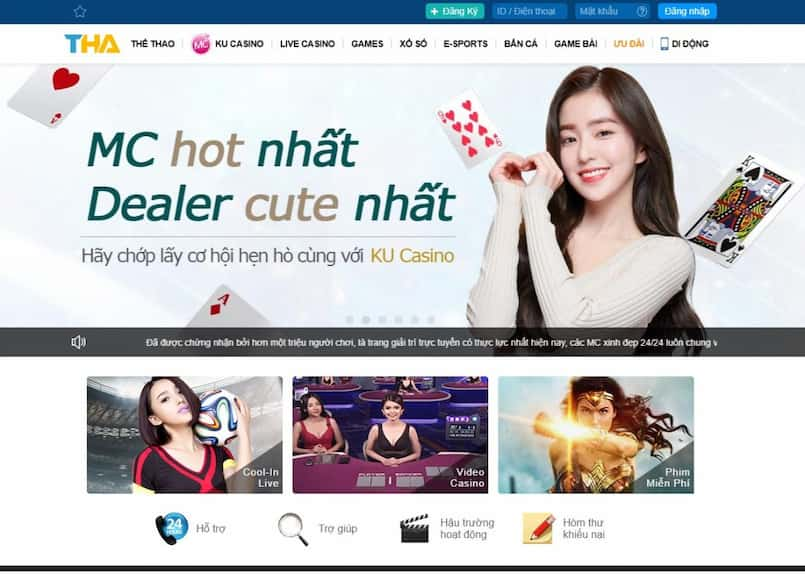

Giao diện Thabet – Tha casino đẹp mắt

Với sự kỹ lưỡng và trau chuốt, nhà cái Tha đã mang đến cho người chơi một cái nhìn về mình một cách tâm huyết nhất.

Để giúp người chơi dễ dàng tiếp cận với giải trí cá cược, Thabet đã tạo ra giao diện thân thiện, gần gũi, có mặt ở khắp mọi nơi. Chỉ cần một thiết bị có thể kết nối mạng, dù là máy tính bàn hay điện thoại, máy tính bảng, .. đều có thể đến với Thabet.

Là một thương hiệu quốc tế, website còn hỗ trợ nhiều ngôn ngữ chứ không chỉ riêng tiếng Việt.

Khi bước vào trang web, bạn sẽ thấy một giao diện được thiết kế đơn giản nhưng không kém phần tinh tế, hình ảnh và chữ viết rõ ràng, sắp xếp hợp lý tạo cảm giác thoải mái cho game thủ.

Bạn sẽ không bị nhầm lẫn với logo cổng game nào khác, ký tự “THA” màu xanh dương tươi sáng nổi bật trên nền trắng sang trọng, các mục trong menu được đơn giản hóa để người chơi dễ tìm nhất có thể.

THA có hệ thống giao dịch nhanh chóng tiện lợi

Ở điểm này, cần phải nhắc lại rằng, giao dịch tại nhà cái Tha, bất kể là gửi hay rút tiền thì tốc độ luôn như nhau. Dù bạn thực hiện các bước như thế nào, chỉ trong vòng 5 đến 10 phút, giao dịch sẽ được kết thúc nhanh chóng.

Hơn nữa, thủ tục giao dịch ở đây không phức tạp với nhiều phương thức thanh toán như internet banking, ví điện tử, .. và nhà cái cũng làm việc với các ngân hàng lớn như ACB, Techcombank, Vietcombank, DongA Bank, Sacombank, Vietinbank, Agribank, BIDV, …

CSKH tuyệt vời từ Thabet – THA

Ngoài chất lượng sản phẩm giải trí, Thabet còn có đội ngũ nhân viên phục vụ khách hàng chất lượng. Được hỗ trợ 24/7, người chơi sẽ được nhân viên hỗ trợ giải đáp mọi thắc mắc của mình bất cứ khi nào bạn cần.

Thabet cách thức liên hệ rất đơn giản, trên trang chủ, bạn chỉ cần tìm mục “Dịch vụ khách hàng”, nhân viên sẽ giải quyết giúp bạn.

Ngoài ra, cổng game còn có mặt trên tất cả các MXH như Zalo, Facebook, Viber,… Bạn cũng có thể đánh giá hoặc khiếu nại khi gặp sản phẩm thông qua “hộp thư khiếu nại” của nhà cái trong menu.

Bảo mật an toàn tuyệt đối

Nhà cái luôn đặt khách hàng lên hàng đầu cũng là yếu tố tạo nên thương hiệu của địa chỉ game. Chắc hẳn, bất kỳ người chơi nào đến với sân chơi cá cược trực tuyến với nỗi lo bị rò rỉ thông tin cá nhân hay các vấn đề về quyền riêng tư thì hãy yên tâm và hãy để Thabet nhận trách nhiệm.

Đây là một nhà cái cá cược chuyên nghiệp và tiên tiến, tính bảo mật thông tin cá nhân ở đây rất cao. Với các kỹ thuật bảo mật công nghệ cao như sử dụng các kỹ thuật mã hóa (RSA 1024 bit và khóa Blowfish 448 bit), hệ thống có tính bảo mật cao hơn hệ thống SSL của các công ty khác và bảo vệ tối đa quyền riêng tư của người chơi.

Hoạt động hợp pháp của Thabet

Về mặt pháp lý, Thabet là một tổ chức kinh doanh hoàn toàn hợp pháp, cụ thể nhà cái này nắm giữ giấy phép hoạt động do PAGCOR. Đây là một giấy phép mạnh mẽ trong thế giới sòng bạc ở Philippines và đủ để chứng minh tính hợp pháp của nhà cái.

Hiện nay, cá cược là trò giải trí có thưởng, mặc dù cá cược ở Việt Nam chưa được chính phủ công nhận. Nhưng ở các nước lân cận như Campuchia hay các nước Châu Âu, cá cược được coi là trò giải trí lành mạnh và hoàn toàn hợp pháp.

Đây cũng là lý do Thabet đặt trụ sở chính tại Philippines, đây là quốc gia có cục quản lý cờ bạc và công nhận sòng bạc là hoạt động kinh doanh hợp pháp.

Đó chỉ là những ưu điểm nổi bật nhất có ở cổng game này, bên cạnh đó còn rất nhiều những điểm mạnh khác. Nhưng chúng tôi sẽ không nói ra ở đây, bởi lẽ anh em tự mình khám phá sẽ hay hơn rất nhiều. Tiếp theo hãy xem cách đăng ký để trải nghiệm nhé!

Thabet- Cách thức đăng ký Thabet để trở thành người chơi

Muốn cá cược ở sân chơi này đòi hỏi anh em phải có cho mình tài khoản cược. Vậy việc đăng ký địa chỉ game này như thế nào? Nó có thực sự gây tốn thời gian và khó khăn cho người chơi. Tìm hiểu nhé!

Bước 1: Tìm đến website Tha uy tín.

Bước 2: Ấn ĐĂNG KÝ xuất hiện ngay ở giao diện cổng game.

Bước 3: Điền thật đầy đủ, thật chính xác yêu cầu mà cổng game đưa ra.

Bước 4: Ấn xác nhận.

Chỉ với 4 bước đơn giản như thế là anh em đã có ngay tài khoản Thabet để cá cược cho riêng mình rồi đấy! Việc đăng ký để đến với sân chơi tuyệt vời này thật đơn giản đúng không nào! Đã đến lúc bạn đăng ký để tham gia rồi đấy! Chúc bạn thành công.

Lời Kết

Trên đây là bài viết được chúng tôi tâm huyết giới thiệu đến bạn đọc về cổng game vạn người mê Thabet. Nếu anh em vẫn chưa có địa chỉ chơi nào thích hợp cho riêng mình thì hãy thử đến đây. Chúng tôi tin chắc bạn sẽ rất dễ bị thích cổng game này đó nhé! Chúc bạn sẽ kiếm được không ít số tiền khủng ở cổng game này.